Section Identifier

贷款

IN THIS SECTION

Federal Loan 项目

联邦贷款是为学生和家长提供的低息贷款,帮助支付学生高中毕业后的教育费用. The lender is the U.S. 而不是银行或其他金融机构.

Student loan borrowing cannot exceed the cost of attendance, 也不能超过联邦贷款设定的年度和终身总额. 教育部在发放贷款时对每笔贷款收取一笔发起费. 你提供的贷款类型是基于你的FAFSA的结果.

Student DIRECT LOAN PROGRAMS

Federal Subsidized Direct Loan Program

Who is eligible? 至少有一半时间并且有经济需要的被录取的本科生. 受助人必须有资格获得联邦援助,且不得超过联邦贷款限额. First-time borrowers must complete entrance counseling.

申请时需要FAFSA,支付此直接联邦贷款时需要签署本票.

Federal Unsubsidized Direct Loan Program

Who is eligible? 入学的本科学生,至少有一半的时间,没有经济需要或独立学生. 受助人必须有资格获得联邦援助,且不得超过联邦贷款限额. Satisfactory academic progress required. First-time borrowers must complete entrance counseling.

申请时需要FAFSA,支付此直接联邦贷款时需要签署本票.

Direct Parent Plus Loan

Federal Direct Parent PLUS Loan

联邦直接父母PLUS贷款是一种基于信用的贷款,适用于参加合格学位或证书课程的受抚养本科生的父母,至少在一半的时间内(每学期6个学分)。. 只有你.S. citizens and permanent residents are eligible.

To apply for the Federal Direct PLUS Loan:

美国.S. 教育部要求任何申请联邦直接PLUS贷款的家长完成FAFSA.

- 去 student loan 网站 operated by the U.S. Department of Education.

- Your parent will need a FSA ID to apply for the PLUS loan. This is the same FSA ID your parent used to complete and sign the FAFSA. If your parent doesn’t have a FSA ID, a link on the student loan 网站 will help them to create one. They must keep this ID, 因为它将在今年和以后的几年里使用,因为你继续申请经济援助.

- 点击“家长借款人”,然后点击链接申请PLUS贷款. 您的父母完成PLUS申请,包括输入他们希望申请的金额. 提交在线申请将允许检查父母的信用.

- 新借款人必须签署主本票,该本票也可在以下网址填写 studentaid.政府

- 此申请应在学期开始前至少六周提交,以便在课程开始时提供直接家长加贷款资金.

Private Alternative Loan

Private or Alternative 贷款

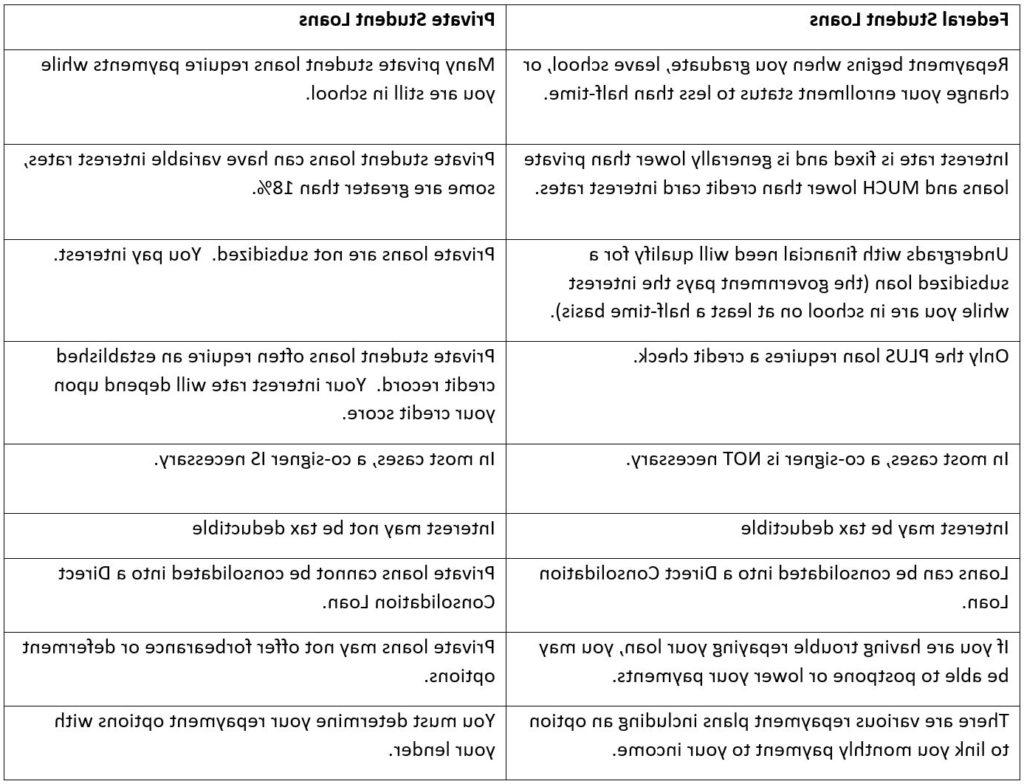

Rather than apply for a Federal PLUS Loan, 一些家庭和学生选择申请私人贷款来资助他们的教育. Before you make that decision, 考虑下表中联邦贷款项目和私人学生贷款项目的区别.

学生在申请学生贷款时可以选择任何贷款人. 作为借款人,做足功课,选择最适合你学业和财务需求的贷款人和贷款是至关重要的, since t在这里 may be differences in interest rates, 费用, credit evaluation, academic progress requirements, repayment terms and borrower benefits. Please visit ElmSelect online lender comparisons to learn more.

在选择其他贷款之前,考虑所有联邦贷款是很重要的. 请务必审查和比较,特别是另类贷款与Plus贷款. 欲了解更多关于联邦和私人学生贷款区别的信息,请访问U.S. Department of Education 网站.

Interest Rates and 费用

利率取决于贷款类型和(对于大多数类型的联邦学生贷款)贷款的第一次支付日期. 下表提供了2023年7月1日或之后首次发放的直接贷款的利率.

| 贷款类型 | Borrower Type | 贷款 first disbursed on or after 7/1/23 and before 7/1/24 |

| Direct Subsized 贷款 | Undergraduate | 5.50% |

| Direct Unsubsidized 贷款 | Undergraduate | 5.50% |

| Direct Unsubsidized 贷款 | Graduate or Professional | 7.05% |

| Direct PLUS 贷款 | 父母 and Graduate or Professional Studies | 8.05% |

以上图表所示的利率均为贷款期限内的固定利率.

Maximum Annual Direct Loan Amounts

DEPENDENT STUDENTS

| Year in School (by credit earned) | Total Base Sub or Unsubsidized Laon | Additional Unsubsidized Loan | 总贷款 |

| 1st (0-27 Credt Hours) | 3,500 | 2,000 | 5,500 |

| 2nd (28-59 Credit Hours) | 4,500 | 2,000 | 6,500 |

| 3rd & 4th (60+ Credit Hours) | 5,500 | 2,000 | 7,500 |

INDEPENDENT STUDENTS

| Year in School (by credit earned) | Total Base Sub or Unsubsidized Laon | Additional Unsubsidized Loan | 总贷款 |

| 1st (0-27 Credt Hours) | 3,500 | 6,000 | 9,500 |

| 2nd (28-59 Credit Hours) | 4,500 | 6,000 | 10,500 |

| 3rd & 4th (60+ Credit Hours) | 5,500 | 7,000 | 12,500 |

Total maximum outstanding debt allowable:

$31,000 for dependent undergraduates

$57,500 for independent undergraduates

父母被拒绝联邦直接父母贷款的受抚养学生可以额外获得最高4美元的无补贴直接贷款,000 for first and second years and $5,000 for third and fourth years.

For more information on federal programs, go to the Federal Student 援助 网站 or call 1-800-4FEDAID.

在联邦学生援助网站上可以找到一个贷款偿还时间表的样本.

Direct MASTER PROMISSORY NOTE

主本票(MPN)是一份联邦法律文件,你承诺偿还你的贷款和任何应计利息和费用给美国.S. Department of Education. 所有联邦直接贷款的借款人在获得联邦贷款之前都需要填写一份MPN. Please visit www.studentaid.政府 填写“直接资助/非资助贷款”及“直系家长PLUS贷款”的个人存款限额.

Student Direct ENTRANCE AND EXIT COUNSELING

所有申请直接补贴贷款或直接无补贴贷款的学生:如果您以前没有在直接贷款计划下获得补贴或无补贴贷款,或在联邦家庭教育贷款(FFEL)计划下获得补贴或无补贴的斯塔福德贷款, you’ll be required to complete entrance counseling. Please visit www.studentiaid.政府 to complete Entrance Counseling.

Exit counseling 为您准备偿还联邦学生贷款提供重要信息。. If you have received a subsidized, unsubsidized or PLUS loan under the Direct Loan Program loan, you must complete exit counseling each time you: 中途退学(少于6学分),毕业或离校. Please visit www.studentiaid.政府 to complete Exit Counseling.

Student Loan Repayment

At Bethany College, we understand that student loans can be intimidating. That’s why we have partnered with Inceptia, a division of the National Student Loan Program, 为你的学生贷款义务提供免费帮助,以确保你感到舒适,并能成功偿还贷款.

inception可能会打电话来帮助你在还款之旅的下一步. Their friendly counselors are t在这里 to help you every step of the way. While you are in your grace period,他们可能会联系你,回答你关于还款选择的问题. If you become 拖欠债务的 关于你的贷款,他们也可能会联系你,帮助你找到一个在你能力范围内的解决方案.

Inceptia辅导员会通过电话与你保持联系,帮助你完成每一步, 信, and/or emails. They will not be collecting money from you. Inceptia的非营利目的是帮助您找到问题的答案和问题的解决方案. We encourage you to visit Inceptia’s Student Loan Knowledge HQ for more information.

You will also want to ensure to understand how to repay your loans. 访问 the U.S. Department of Education 网站 for detailed information and options.

如果由于某种原因你发现自己无法付款,你还有其他选择. 点击 在这里 to learn more.

信息

访问

应用

存款